The Tribunal aims to manage its workload in an effective and efficient manner, responding to changes in the number and nature of applications over time. Performance targets define standards for dealing with applications, and assist us to meet the outcome and program requirements defined in the Portfolio Budget Statements.

Workload overview

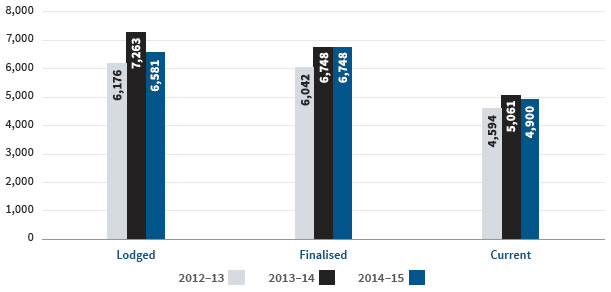

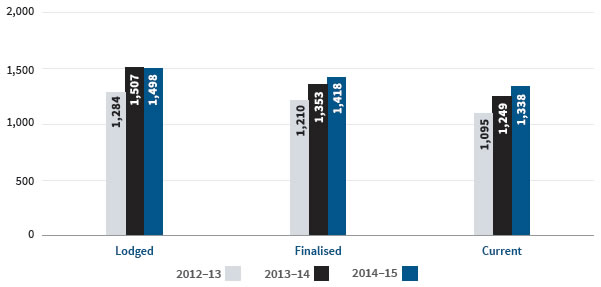

The AAT received 6,581 applications and finalised 6,748 applications in 2014–15. There were 4,900 applications current at 30 June 2015.

Lodgements during the reporting year were nine per cent lower than in 2013–14. While there was an increase in the number of applications relating to social security decisions, there was a significant decrease in applications for review of taxation decisions. Lodgements in our other major jurisdictions – veterans' affairs and workers' compensation – remained relatively steady.

In relation to finalisations, the AAT completed the same number of applications in 2014–15 as it did in 2013–14. Finalisation patterns reflect recent lodgement trends with increases in the social security and workers' compensation jurisdictions and a decline in the number of taxation applications finalised.

The number of applications on hand at 30 June 2015 was three per cent lower than the previous year, reflecting the overall decline in lodgements in 2014–15. The majority of applications on hand at 30 June 2015 were less than 12 months old with some increase in the proportion of cases older than 12 months.

Chart 3.1 shows applications lodged and finalised in the three most recent reporting years, and applications current at 30 June in each year. More detailed information on the types of applications lodged and finalised, and the outcomes of cases finalised during the reporting year, is available in Appendix 4.

Chart 3.1 Applications lodged, finalised and current – Total

Workload by jurisdiction

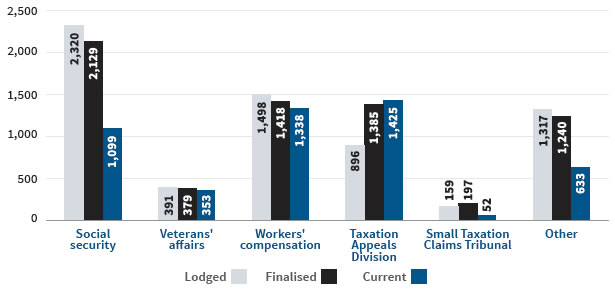

Applications for review of social security decisions were the most common type of application lodged with the AAT in 2014–15, constituting 35 per cent of all lodgements. Applications in the workers' compensation and taxation jurisdictions comprised 23 per cent and 16 per cent of all lodgements respectively. The veterans' appeals jurisdiction was six per cent of all lodgements. All other applications constituted 20 per cent of total lodgements.

The taxation jurisdiction is the only one in which the number of applications finalised was greater than the number lodged in 2014–15. Clearance rates were higher than 90 per cent in the social security, veterans' affairs and workers' compensation jurisdictions as well as in relation to all other types of applications.

The number of applications lodged and finalised in each of our major jurisdictions in 2014–15 and the number of applications on hand at 30 June 2015 is shown in Chart 3.2.

Chart 3.2 Applications lodged, finalised and current in 2014–15 – By jurisdiction

Social security

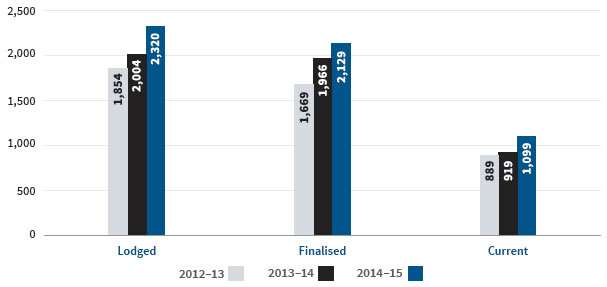

The number of applications for review of family assistance and social security decisions lodged with the AAT in 2014–15 was 16 per cent higher than in 2013–14, as shown in Chart 3.3. This rate of increase was double the size of the increase recorded in the preceding year. Applications about age pension, disability support pension and overpayments and debt recovery were the principal sources of the increase in lodgements in 2014–15.

The departments that administer family assistance and social security entitlements lodged 104 applications in 2014–15, four per cent of total lodgements in this jurisdiction. This compares with 54 and 47 applications lodged in the preceding two years respectively.

The number of applications finalised in 2014–15 increased by eight per cent, reflecting the increase in lodgements in this jurisdiction. The significant increase in lodgements during the reporting year has led to a 20 per cent increase in applications on hand at 30 June 2015.

Chart 3.3 Applications lodged, finalised and current – Social security

Veterans' affairs

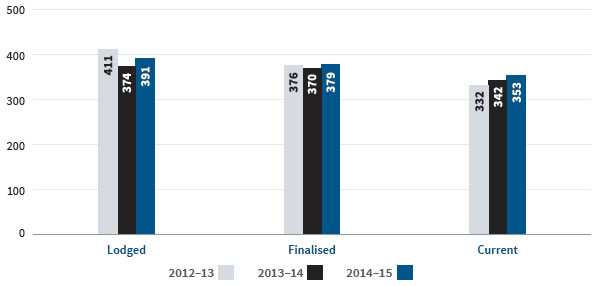

The number of applications lodged in the veterans' affairs jurisdiction increased only marginally in 2014–15. This relates primarily to a greater number of applications for review of decisions under the Veterans' Entitlements Act 1986 relating to disability pension. Overall, lodgements in this jurisdiction have remained relatively consistent in recent years.

As shown in Chart 3.4, there was a small increase in the number of applications finalised in 2014–15 as well as in the number of current applications at 30 June 2015.

Chart 3.4 Applications lodged, finalised and current – Veterans' affairs

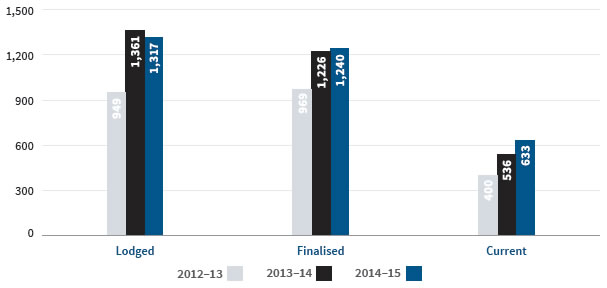

Workers' compensation

Lodgements in the workers' compensation jurisdiction in 2014–15 were similar to 2013–14 both in relation to applications for review of decisions made under the Safety, Rehabilitation and Compensation Act 1988 and under the Seafarers Rehabilitation and Compensation Act 1992. While there was an increase in applications relating to decisions made by Comcare, there were fewer applications for review of decisions made by the Linfox group of companies and the Military Rehabilitation and Compensation Commission.

The number of compensation applications finalised in 2014–15 rose by five per cent and the number of applications on hand at 30 June 2015 rose by seven per cent, as shown in Chart 3.5. These trends reflect the overall increase in lodgements in this jurisdiction in the last two reporting years.

Chart 3.5 Applications lodged, finalised and current – Workers' compensation

Taxation

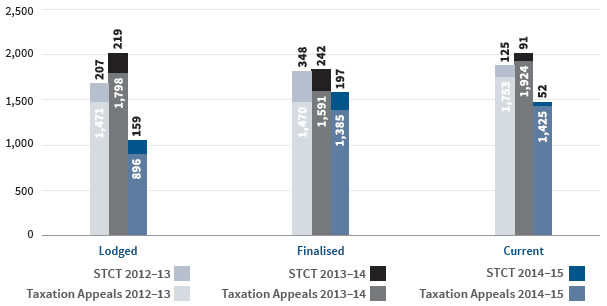

The number of applications lodged in the Taxation Appeals Division declined by 50 per cent in 2014–15. While the number of applications decreased for most case types, it was most marked in relation to applications for review of decisions relating to income tax. The commitment of the Australian Taxation Office (ATO) to new processes that facilitate the earlier resolution of matters which otherwise may have resulted in applications to the AAT is likely to have contributed to this result. These changes in the ATO's processes are likely to affect the AAT's case mix with the proportion of complex or intractable disputes increasing. The significant fall in lodgements led to a 13 per cent decrease in the number of applications finalised in 2014–15 and a 26 per cent decrease in the number of applications on hand at 30 June 2015, as shown in Chart 3.6.

There was a 27 per cent decrease in lodgements in the Small Taxation Claims Tribunal in 2014–15 which can also be attributed primarily to a fall in the number of applications for review of income tax decisions. The number of finalisations was 19 per cent lower than in 2013–14. With finalisations exceeding lodgements for a third consecutive year, the number of applications on hand at 30 June 2015 declined by 43 per cent.

Chart 3.6 Applications lodged, finalised and current – Taxation Appeals Division and Small Taxation Claims Tribunal

Other jurisdictions and applications

The overall number of applications lodged in the AAT's other jurisdictions fell marginally in 2014–15 following a significant increase in 2013–14. There were increases in the number of applications for review of a range of decision types in 2014–15, including decisions about citizenship, the fair entitlements guarantee, freedom of information and marriage celebrants. These were offset by decreases in the number of applications about civil aviation and customs decisions as well as a significant decline in the number of stand-alone applications lodged with the AAT seeking an extension of time within which to lodge an application for review.

The number of finalisations in these areas of our work in 2014–15 was similar to 2013–14. As lodgements continued to exceed the number of finalisations, there was an 18 per cent increase in applications on hand at 30 June 2015.

The Tribunal received 18 applications for review of decisions made by the National Disability Insurance Agency in 2014–15, similar to the number received in 2013–14. Eighteen applications were finalised in 2014–15 with 12 outstanding as at 30 June 2015.

Chart 3.7 Applications lodged, finalised and current – Other jurisdictions and applications

Performance

Outcome and performance information

The AAT had one outcome specified in the 2014–15 Portfolio Budget Statements:

Access to a fair, just, economical, informal and quick review mechanism for applicants through reviews of government administrative decisions, including dispute resolution processes and independent formal hearings.

We are a single-program agency.

Deliverables

The AAT's primary deliverables for 2014–15 were completed reviews of decisions, and there were two paths to achieving them:

- applications finalised without a hearing, and

- applications finalised with a hearing.

Our deliverables targets and our actual performance for 2014–15 are shown in Table 3.8.

Table 3.8 Deliverables targets and results, 2014–15

| |

Target

|

Result

|

Applications finalised without a hearing

Number of matters finalised without a hearing |

6,295

|

5,406

|

Applications finalised with a hearing

Number of matters finalised with a hearing |

1,574

|

1,342

|

The number of applications finalised by the AAT, both with and without a hearing, was lower than the budget projections for 2014–15. We received a lower than anticipated number of applications for review of decisions relating to the National Disability Insurance Scheme.

Key performance indicators

The AAT's key performance indicators for 2014–15 were:

- to finalise 75 per cent of applications within 12 months of lodgement, and

- to resolve 80 per cent of applications without a hearing.

For the second indicator, we use alternative dispute resolution to help the parties try to reach agreement about how their case should be resolved. The Tribunal conducts a hearing and make a decision if an application cannot otherwise be resolved.

The AAT's actual performance for 2014–15 is shown in Table 3.9.

Table 3.9 Key performance indicators and results, 2014–15

| |

Target

|

Result

|

| Percentage of applications finalised within 12 months of lodgement |

75%

|

78%

|

| Percentage of applications resolved without a hearing |

80%

|

80%

|

In relation to the timeliness of dealing with applications, we exceeded the target in the Portfolio Budget Statements by three percentage points. This target was also exceeded in the two previous financial years: 76 per cent of applications were finalised within 12 months in 2012–13 and 82 per cent in 2013–14. More information about timeliness is set out below.

In relation to resolving applications without a hearing, we met the target of 80 per cent in 2014–15. While higher than the 79 per cent result for 2012–13, it is lower than the 82 per cent result achieved in 2013–14. For more information on the percentage of applications finalised without a hearing in each of the major jurisdictions, see Table A4.4 in Appendix 4.

See Appendix 5 for the summary table showing total resources for the AAT compared with the total payments made during 2014–15. The appendix also includes a summary table showing the total resources for the AAT's outcome.

Time standards

We monitor our performance against time standards for steps in the review process as well as for the finalisation of applications, both generally and in our major jurisdictions.

Time standards for steps in the review process

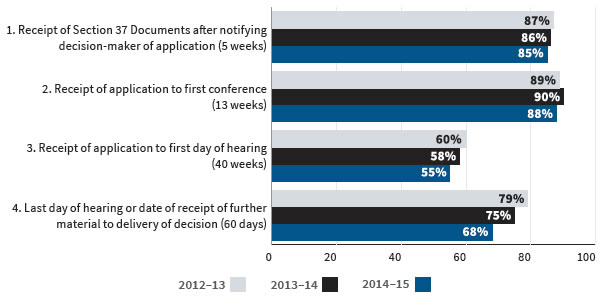

We report on the timeliness of completing four steps in the review process:

- the time taken by the decision-maker to lodge the documents relating to the decision under review that are required under section 37 of the Administrative Appeals Tribunal Act 1975 after receiving notice of an application

- the time between lodging an application and holding the first conference

- the time between lodging an application and holding a hearing

- the time taken by the Tribunal to deliver a decision following the last day of hearing or the date of receipt of further material after a hearing.

The decision-maker controls step one; the AAT and the parties share the responsibility for the timeliness of steps two and three; and the AAT controls the timeliness of step four.

Timeliness results for 2014–15 and the two previous reporting periods are shown in Chart 3.10.

Chart 3.10 Performance against time standards

The proportion of applications in which the decision-maker lodged the Section 37 Documents within five weeks of receiving notice of the application was again marginally lower in 2014–15 than in the previous year.

We continued to hold a high proportion of first conferences within 13 weeks of the lodgement of an application in 2014–15. However, the proportion of applications in which the hearing was held within 40 weeks of lodgement decreased further in the reporting year as did the proportion of decisions delivered within 60 days after a hearing.

Time standards for finalising applications in major jurisdictions

We aim to finalise the majority of applications within 12 months of lodgement with specific targets set for each of the major jurisdictions. In relation to the Small Taxation Claims Tribunal, our goal was to finalise applications within 12 weeks of lodgement.

Our results for 2014–15 and the two previous reporting years are in Table 3.11.

Table 3.11 Percentage of applications finalised within time standards

|

Jurisdiction

|

Target

%

|

2012–13

%

|

2013–14

%

|

2014–15

%

|

| All |

—

|

76

|

82

|

78

|

| Social securitya |

90

|

93

|

93

|

93

|

| Veterans' affairsa |

80

|

70

|

70

|

61

|

| Workers' compensationa |

75

|

68

|

70

|

65

|

| Taxation Appeals Divisiona |

75

|

67

|

77

|

73

|

| Small Taxation Claims Tribunalb |

–

|

27

|

33

|

37

|

a Time standard: percentage of applications finalised within 12 months

b Time standard: percentage of applications finalised within 12 weeks

The proportion of applications finalised within 12 months in the social security jurisdiction in 2014–15 exceeded the 90 per cent target by three percentage points. This is consistent with the results achieved in the previous two reporting years. Sixty-seven per cent of all social security applications were finalised within six months of lodgement, and 98 per cent within 18 months.

The level of performance in the veterans' affairs jurisdiction declined in 2014–15 with 61 per cent of applications finalised within 12 months compared to 70 per cent in the previous two financial years. Eighty-five per cent of applications were finalised within 18 months, compared with 87 per cent in 2013–14.

In the workers' compensation jurisdiction, the 65 per cent result achieved in 2014–15 was five percentage points lower than the result for 2013–14. Eighty-seven per cent of applications were finalised within 18 months, marginally lower than the result achieved in 2013–14.

The proportion of applications finalised within 12 months in the Taxation Appeals Division fell from 77 per cent in 2013–14 to 73 per cent in the reporting year. However, the level of performance achieved in 2014–15 remains higher than the results for the years prior to 2013–14. Eighty-seven per cent of applications were finalised within 18 months in the reporting year, which was consistent with the previous year.

In the Small Taxation Claims Tribunal, the proportion of applications finalised within 12 weeks improved by four percentage points but remained relatively low. Our experience has been that applications dealt with in the Small Taxation Claims Tribunal cannot necessarily be completed faster than other types of taxation reviews.

There are a range of reasons why an application may not proceed to hearing or be finalised within the time standards. The pace that applications progress through the pre-hearing stage is heavily influenced by the time the parties need to undertake relevant investigations, obtain expert evidence and gather other relevant material. This is particularly so for applications in the veteran's affairs and workers' compensation jurisdictions where considerable investigation and evidence gathering is often not commenced, particularly by an applicant, until the review process begins. In workers' compensation applications, an applicant who receives a favourable outcome at the AAT can only recover legal costs, including the costs of obtaining medical evidence, that have been incurred in relation to the AAT review process. Some applications can also be delayed pending a decision by the decision-maker on a related matter, by criminal proceedings or because additional time is required to allow the parties a further opportunity to resolve the dispute without a hearing. In some cases, parties cannot proceed because of illness or other adverse circumstances. The AAT's ability to list hearings in a timely manner is affected by the number of members who can be listed as well as the availability of parties, representatives and witnesses, particularly expert witnesses. Delays in the delivery of decisions following a hearing can also contribute to delays in finalising applications.

We continued to monitor the time that applications spend in each of the major stages of review in 2014–15 and registries conducted regular file audits on older cases. We will continue to identify sources of avoidable delay, and work with stakeholders on minimising such delays.

External scrutiny

AAT decisions may be appealed to the courts. Our operations are also subject to external scrutiny by way of complaints to the Commonwealth Ombudsman and other bodies, requests under the Freedom of Information Act 1982, inquiries by Parliamentary Committees and audits by the Australian National Audit Office.

Appeals against AAT decisions

A party could appeal to the Federal Court, on a question of law, against most types of final decisions made by the AAT in 2014–15 pursuant to section 44 of the Administrative Appeals Tribunal Act 1975 (section 44 appeals). The Federal Court could transfer the appeal to the Federal Circuit Court unless the Tribunal was constituted by, or included, a presidential member.

A party could also seek judicial review of decisions made in the course of the review process and in respect of certain final decisions under the Administrative Decisions (Judicial Review) Act 1977, section 39B of the Judiciary Act 1903, Part 8 of the Migration Act 1958 or section 75(v) of the Constitution. Applications could be made to the Federal Court, the Federal Circuit Court or the High Court.

In 2014–15, 91 section 44 appeals were lodged with the Federal Court. There were six applications for judicial review made under other enactments, two of which related to decisions concerning visas under the Migration Act 1958. Table A4.9 in Appendix 4 provides information on the number of appeals lodged against decisions in each of the AAT's major jurisdictions.

During the reporting year, 104 section 44 appeals and 16 applications for judicial review made under other enactments were finally determined in the courts. The AAT's decision was set aside in 29 cases, representing 24 per cent of all appeals determined and less than one per cent of all applications that the AAT finalised in the reporting year. The proportion of AAT decisions set aside on appeal improved by four percentage points in 2014–15. In 2013–14, the AAT's decision was set aside in 35 cases, representing 28 per cent of all appeals determined in that year.

Table A4.10 in Appendix 4 offers more information on appeals determined during the reporting year and their outcomes.

During the reporting year, there were no judicial decisions or decisions of other tribunals that had, or may have had, a significant impact on the operations of the AAT.

Freedom of information

The AAT received nine requests for access to documents under the Freedom of Information Act 1982 in 2014–15. One request made in 2013–14 was outstanding at the beginning of the reporting period. Table 3.12 shows the number of requests made over the last three years.

Table 3.12 Freedom of information requests

| |

2012–13

|

2013–14

|

2014–15

|

| Number of requests made |

7

|

10

|

9

|

The outstanding request from 2013–14 and all requests made to the AAT in 2014–15 were finalised in the reporting year. There were no requests outstanding at 30 June 2015.

Of the ten requests that were finalised, four requests were granted in full and two were granted in part. Four requests were refused, three on the basis that the AAT held no documents falling within the scope of the request.

An application was lodged with the Office of the Australian Information Commissioner (OAIC) during the reporting period for review of one of the AAT's refusal decisions. The OAIC exercised its discretion not to review the decision on the basis that the application was misconceived.

The AAT did not receive any requests to amend or annotate records.

Information Publication Scheme

Agencies subject to the Freedom of Information Act 1982 are required to publish information to the public as part of the Information Publication Scheme (IPS). This requirement is in Part II of the Freedom of Information Act 1982 and has replaced the former requirement to publish a section 8 statement in an annual report. Each agency must display on its website a plan showing what information it publishes in accordance with the IPS requirements. The AAT's plan is on the website.

Ombudsman

During 2014–15, the Commonwealth Ombudsman received 40 approaches concerning the AAT. The Ombudsman conducted two investigations and concluded no further investigation was warranted in all of the circumstances.

Complaints to other bodies

No complaints were made to the Australian Human Rights Commission during the reporting period. The AAT did not receive notice of any complaints from the Office of the Australian Information Commissioner.

Reports by the Auditor-General or parliamentary committees

The AAT's operations were not the subject of any report by the Auditor-General or any Parliamentary Committee during the reporting period.

Service Charter

The AAT has a Service Charter which sets out our service standards and information relating to making complaints about the Tribunal, including the standards for responding to complaints.

Information on the extent of the Tribunal's compliance with the service standards in place during 2014–15 (where information is available) is in Table 3.13.

Table 3.13 Service standards

|

Commitment

|

Result for 2014–15

|

| We will treat you with respect and courtesy |

| We will be polite, respectful and courteous and use language that is clear and understandable. |

AAT members and staff strive to be polite, respectful and courteous and use clear and understandable language so that Tribunal users can understand our processes. Of the complaints finalised in 2014–15, two involved adverse findings in relation to issues of this kind. |

| We will make ourselves accessible |

| Country residents can contact us on our national telephone number for the cost of a local call. |

The AAT's national 1300 telephone number was available throughout the year. |

| People who are deaf or have a hearing or speech impairment can contact the AAT. |

The AAT used the National Relay Service to provide users with a range of call options including TTY as well as internet, SMS and video relay. |

| Wheelchair access and hearing induction loops will be available at each office. |

All AAT premises were wheelchair-accessible. Portable induction loops were available at each of our registries. |

| Hearings will be held in capital cities and in country centres. |

The AAT conducted 26 hearings, three conferences, two conciliations, one mediation and one interlocutory hearing in locations outside capital cities. |

| Where appropriate you may participate in a hearing by telephone or by video-link. |

The AAT conducted the following listings by telephone or by video-link:

- conferences — 6,139

- other alternative dispute resolution processes — 12

- directions hearings — 1,332

- interlocutory hearings — 351

- hearings — 87

|

| If you need an interpreter, we will provide one free of charge. |

The AAT arranged for an interpreter to participate in an alternative dispute resolution process or hearing where needed. Interpreters were provided free of charge. |

| If you are self-represented, we will help you understand Tribunal procedures through our Outreach program. Outreach officers will contact self-represented parties by telephone within six weeks of an application being lodged. |

Data collated for Outreach, for 1,328 parties, shows the average time from lodgement of an application to Outreach contact was 41 days. |

| We will deal with you fairly |

| A private conference will usually be held within 10 weeks of an application being lodged. |

69 per cent of first conferences were held within 10 weeks of lodgement, which was five percentage points lower than the 74 per cent result achieved in 2013–14. |

| We will operate in an efficient manner |

| If a decision was not given orally at a hearing, written decisions will usually be provided within two months. |

68 per cent of decisions were delivered within 60 days of the last day of hearing or the receipt of further submissions or other material, which was seven percentage points lower than the 75 per cent result achieved in 2013–14 (see Chart 3.10). |

Complaints to the AAT

Complaints may be made to the AAT orally or in writing. When a complaint is made in person or by telephone, the AAT attempts to resolve it immediately. We aim to respond to written complaints within 20 working days. If more time is required, because of the complexity of the complaint or the need to consult with other persons before providing a response, the AAT advises the complainant of progress in handling the complaint.

The AAT treats all complaints seriously and conducts investigations in an impartial manner as quickly as possible having regard to the principles of procedural fairness. Possible responses to a complaint include the provision of information or an explanation, an apology, a change to practice and procedure or consideration of additional training and development for AAT personnel.

During 2014–15, the AAT received complaints from 28 individuals. Table 3.14 shows the number of complaints made over the three most recent reporting years. The 28 complaints made in 2014–15 were about the issues shown in Table 3.15.

Table 3.14 Complaints to the AAT

| |

2012–13

|

2013–14

|

2014–15

|

| Number of complaints made |

24

|

25

|

28

|

Table 3.15 Issues raised in complaints to the AAT

|

Issue

|

Number of complaints

|

| Tribunal decisions |

10

|

| General procedural issues |

8

|

| Conduct of AAT members |

4

|

| Conduct of AAT staff |

4

|

| Conduct of conferences |

2

|

| Total |

28

|

The AAT provided a response to 28 complaints in 2014–15. The AAT responded to 27 of the 28 complaints within 20 working days. The average number of days from complaint to final response was 12 working days.

The AAT found that it could have handled matters more appropriately in relation to three complaints, which raised issues concerning the progress of an application for review and the conduct of AAT personnel. The Tribunal offered an apology in each case and raised the matters with the relevant personnel.

Additional functions conferred on tribunal members

As well as performing their role under the Administrative Appeals Tribunal Act 1975, AAT members may exercise powers under a range of other Acts in their personal capacity.

Warrants, controlled operations and other functions

Members of the AAT who meet the qualification requirements set out in the legislation may be nominated by the responsible Minister to:

- issue telecommunications interception warrants and stored communications warrants under the Telecommunications (Interception and Access) Act 1979

- issue warrants and exercise related powers under the Surveillance Devices Act 2004

- vary controlled operations authorities and issue delayed notification search warrants under the Crimes Act 1914

- make continued preventative detention orders under the Criminal Code Act 1995

- issue examination notices under the Fair Work (Building Industry) Act 2012

- make orders allowing information given to the Inspector of Transport Security to be disclosed to another government agency under the Inspector of Transport Security Act 2006, and

- issue search warrants and exercise related powers under the Tobacco Plain Packaging Act 2011.

For some of these functions, only the President and Deputy Presidents may be nominated to exercise the power. In relation to other functions, Senior Members and Members who have been enrolled as a legal practitioner for at least five years may be nominated.

All members of the AAT are authorised to exercise a range of powers relating to monitoring overseas students' compliance with visa conditions under the Education Services for Overseas Students Act 2000 and the Migration Act 1958.

Table 3.16 shows the number of occasions on which AAT members considered applications under any of the above Acts over the past three years. There was a small increase in the number of occasions in 2014–15.

Table 3.16 Applications relating to warrants, controlled operations and other functions considered by AAT members

| |

2012–13

|

2013–14

|

2014–15

|

| Number of occasions on which applications considered |

2,764

|

2,715

|

2,786

|

The AAT is flexible in performing these functions and members are available outside standard business hours. In the reporting period, there were 162 out-of-hours appointments held.

In a proportion of applications, the issue of a warrant or other authorisation is only granted after further information is provided at the request of the authorised member. A small number of warrant applications are refused, some only granted after conditions are imposed (including conditions in relation to privacy) and, in some instances, the warrant is issued for a lesser period of time than that sought by the law enforcement agency.

Proceeds of crime examinations

All presidential members of the AAT, and any Senior Member or Member who has been enrolled as a legal practitioner for at least five years, may be appointed by the responsible Minister as an approved examiner under the Proceeds of Crime Act 2002 or the Proceeds of Crime Regulations 2002. Approved examiners are authorised to issue examination notices at the request of the Australian Federal Police and to oversee compulsory examinations in connection with confiscation proceedings.

Table 3.17 shows the number of examination sessions conducted by AAT members in the last three years. The number of examinations has increased substantially in the past year.

Table 3.17 Examinations held under the Proceeds of Crime Act 2002

| |

2012–13

|

2013–14

|

2014–15

|

| Number of examination sessions held |

28

|

28

|

57

|