Appendix // 01 Members of the AAT

Table A1.1 sets out a list of the members of the AAT as at 30 June 2015. Lists of the members who were appointed and reappointed in 2014–15 and members whose terms of appointment ended during the reporting year follow the table.

The list of members in Table A1.1 is ordered by membership category and then alphabetically. For members who have been reappointed, the first appointment date reflects the date from which there have been continuous appointments to the AAT.

The President, other judges and Deputy Presidents can exercise the powers of the Tribunal in any of the AAT's divisions. Senior Members and Members may exercise the powers of the Tribunal only in the divisions to which they have been assigned. The divisions to which Senior Members and Members were assigned as at 30 June 2015 are indicated in the table as follows:

G General Administrative Division

N National Disability Insurance Scheme Division

S Security Appeals Division

T Taxation Appeals Division

V Veterans' Appeals Division

Table A1.1 Members of the AAT, 30 June 2015

|

Name

|

First appointed

|

Appointment expires

|

Location

|

Divisions

|

| President |

| The Hon Justice Duncan Kerr, Chev LH |

16/05/2012 |

15/05/2017 |

Hobart |

|

| Presidential members – Judges of the Federal Court of Australia |

| The Hon Justice Michael Barker |

24/11/2010 |

23/11/2015 |

Perth |

|

| The Hon Justice Annabelle Bennett AO |

23/11/2005 |

23/11/2015 |

Sydney |

|

| The Hon Justice Richard Edmonds |

23/11/2005 |

23/11/2015 |

Sydney |

|

| The Hon Justice Andrew Greenwood |

23/11/2005 |

23/11/2015 |

Brisbane |

|

| The Hon Justice Jayne Jagot |

24/11/2010 |

23/11/2015 |

Sydney |

|

| The Hon Justice Susan Kenny |

24/11/2010 |

23/11/2015 |

Melbourne |

|

| The Hon Justice John Logan RFD |

24/11/2010 |

23/11/2015 |

Brisbane |

|

| The Hon Justice John Mansfield AM |

24/11/2010 |

23/11/2015 |

Adelaide |

|

| The Hon Justice John Middleton |

24/11/2010 |

23/11/2015 |

Melbourne |

|

| The Hon Justice Tony Pagone |

29/05/2015 |

28/05/2020 |

Melbourne |

|

| The Hon Justice Nye Perram |

16/05/2013 |

15/05/2018 |

Sydney |

|

| The Hon Justice Antony Siopis |

23/11/2005 |

23/11/2015 |

Perth |

|

| The Hon Justice Richard White |

29/05/2015 |

28/05/2020 |

Adelaide |

|

| Presidential members – Judges of the Family Court of Australia |

| The Hon Justice Robert Benjamin |

23/11/2005 |

23/11/2015 |

Hobart |

|

| The Hon Justice Victoria Bennett |

29/05/2015 |

28/05/2020 |

Melbourne |

|

| The Hon Justice David Berman |

29/05/2015 |

28/05/2020 |

Adelaide |

|

| The Hon Justice Christine Dawe |

23/11/2005 |

23/11/2015 |

Adelaide |

|

| The Hon Justice Mary Finn |

23/11/2005 |

23/11/2015 |

Canberra |

|

| The Hon Justice Colin Forrest |

29/05/2015 |

28/05/2020 |

Brisbane |

|

| The Hon Justice Janine Stevenson |

29/05/2015 |

28/05/2020 |

Sydney |

|

| Presidential members – Deputy Presidents – Full-time |

| Ms Katherine Bean |

7/12/2009 |

31 May 2018 |

Adelaide |

|

| Mr James Constance |

9/12/2010 |

8/12/2015 |

Sydney |

|

| Miss Stephanie Forgie |

8/09/1988 |

3/11/2021 |

Melbourne |

|

| Mr Philip Hack SC |

9/01/2006 |

30/11/2015 |

Brisbane |

|

| Mr Gary Humphries |

1/01/2015 |

31/12/2019 |

Canberra |

|

| Dr Christopher Kendall |

5/09/2014 |

29/06/2020 |

Perth |

|

| Presidential members – Deputy Presidents – Part-time |

| Ms Fiona Alpins |

5/04/2012 |

4/04/2017 |

Melbourne |

|

| Professor Robert Deutsch |

5/04/2012 |

4/04/2017 |

Sydney |

|

| Mr Stephen Frost |

24/08/2006 |

4/04/2017 |

Sydney |

|

| Major General Gregory Melick AO RFD SC |

5/09/2014 |

4/09/2019 |

Hobart |

|

| Mr Ian Molloy |

11/04/2013 |

10/04/2018 |

Brisbane |

|

| The Hon Robert Nicholson AO |

6/09/2007 |

26/10/2015 |

Perth |

|

| The Hon Brian Tamberlin QC |

23/11/2005 |

29/09/2015 |

Sydney |

|

| Senior Members – Full-time |

| Dr Damien Cremean |

1/06/2015 |

31/05/2020 |

Melbourne |

G, S, V |

| Mr Egon Fice |

12/06/2003 |

31/05/2018 |

Melbourne |

G, S, T, V |

| Mr John Handley |

14/06/1989 |

3/05/2018 |

Melbourne |

G, N, T, V |

| Mr Bernard McCabe |

1/07/2001 |

30/11/2016 |

Brisbane |

G, S, T ,V |

| Dr Peter McDermott RFD |

15/11/2004 |

14/02/2018 |

Brisbane |

G, T, V |

| Dr James Popple |

1/01/2015 |

31/12/2017 |

Canberra |

G, S, T, V |

| Ms Jill Toohey |

17/08/2009 |

4/09/2017 |

Sydney |

G, N, S, T, V |

| Senior Members – Part-time |

| Mr Anthony Cotter |

5/09/2014 |

4/09/2019 |

Brisbane |

G, T, V |

| Ms Ann Cunningham |

5/09/1995 |

30/11/2017 |

Hobart |

G, N, S, T, V |

| Mr Rodney Dunne |

15/06/2005 |

31/05/2018 |

Adelaide |

G, T, V |

| Ms Geri Ettinger |

19/06/1991 |

25/01/2016 |

Sydney |

G, S, T, V |

| Ms Naida Isenberg |

1/07/2001 |

30/11/ 2017 |

Sydney |

G, S, V |

| Ms Gina Lazanas |

5/04/2012 |

4/04/2017 |

Sydney |

G, T, V |

| Dr Kenneth Levy RFD |

5/07/2004 |

30/11/2016 |

Brisbane |

G, T, V |

| Dr Nicholas Manetta |

5/08/2013 |

4/08/2018 |

Adelaide |

G, V |

| Dr Teresa Nicoletti |

24/08/2006 |

30/11/2017 |

Sydney |

G, V |

| Mr Francis O'Loughlin |

23/09/2009 |

16/01/2017 |

Melbourne |

G, T, V |

| Mr Peter Taylor SC |

24/08/2006 |

30/11/2017 |

Sydney |

G, T, V |

| Ms Chelsea Walsh |

1/06/2010 |

31/05/2018 |

Perth |

G, T, V |

| Members – Full-time |

| Ms Regina Perton OAM |

9/08/2004 |

4/09/2017 |

Melbourne |

G, N, S, V |

| Members – Part-time |

| Dr Ion Alexander |

2/08/2004 |

25/01/2017 |

Sydney |

G, V |

| Mr Ronald Bartsch |

11/04/2013 |

10/04/2018 |

Sydney |

G |

| Professor David Ben-Tovim |

1/12/2010 |

30/11/2015 |

Adelaide |

G, N, V |

| Dr Michael Couch |

5/04/2012 |

4/04/2017 |

Sydney |

G, V |

| Ms Lynne Coulson Barr |

5/08/2013 |

4/04/2018 |

Melbourne |

G, N |

| Air Vice Marshal Franklin Cox AO (ret'd) |

24/08/2006 |

30/11/2015 |

Canberra |

G, V |

| Dr Marella Denovan |

15/12/2005 |

30/11/2015 |

Brisbane |

G, V |

| Brigadier Conrad Ermert (ret'd) |

19/06/1991 |

31/05/ 2017 |

Melbourne |

G, T, V |

| Mr Warren Evans |

21/09/2006 |

30/11/2016 |

Perth |

G, V |

| Mr Nicholas Gaudion |

11/04/2013 |

10/04/2018 |

Sydney |

G, T |

| Dr Gordon Hughes |

5/07/2004 |

16/01/2017 |

Melbourne |

G, T, V |

| Dr Bernard Hughson |

1/12/2010 |

30/11/2015 |

Canberra |

G, N, V |

| Dr William Isles |

5/04/2012 |

4/04/2017 |

Sydney |

G, N, V |

| Professor Ronald McCallum AO |

5/08/2013 |

4/08/2018 |

Sydney |

G, N |

| Lieutenant Colonel Robert Ormston (ret'd) |

1/09/2011 |

31/08/2016 |

Adelaide |

G, S, V |

| Miss Anne Shanahan |

19/06/1991 |

16/04/2018 |

Melbourne |

G, V |

| Dr Leslie Stephan |

26/06/2015 |

25/06/2020 |

Adelaide |

G, V |

| Dr Marian Sullivan |

5/04/2012 |

4/04/2017 |

Brisbane |

G, V |

| Ms Sandra Taglieri |

5/08/2013 |

4/08/2018 |

Hobart |

G, N |

| Mr Ian Thompson |

5/08/2013 |

4/08/2018 |

Adelaide |

G, N |

| Dr Hooi Toh |

24/08/2006 |

30/11/2017 |

Sydney |

G, N, V |

| Dr Robert Walters RFD |

16/11/2006 |

30/11/2017 |

Hobart |

G, V |

| Brigadier Gerard Warner AM LVO (ret'd) |

15/06/2005 |

31/05/2018 |

Perth |

G, N, S, V |

| Mr Simon Webb |

16/07/2001 |

4/09/2017 |

Canberra |

G, V |

| Dr Peter Wilkins MBE |

24/08/2006 |

30/11/2015 |

Canberra |

G, N, V |

Appointments and cessations, 2014–15

New appointments

The Hon Justice Victoria Bennett

The Hon Justice David Berman

The Hon Justice Colin Forrest

The Hon Justice Tony Pagone

The Hon Justice Janine Stevenson

The Hon Justice Richard White

Deputy President Gary Humphries

Deputy President Dr Christopher Kendall

Deputy President Major-General Gregory Melick AO RFD SC

Senior Member Anthony Cotter

Senior Member Dr Damien Cremean

Senior Member Dr James Popple

Member Dr Leslie Stephan

Re-appointments

Deputy President the Hon Brian Tamberlin QC

Senior Member Rodney Dunne

Senior Member Geri Ettinger

Senior Member Egon Fice

Senior Member Dr Peter McDermott RFD

Senior Member Francis O'Loughlin

Senior Member Jill Toohey

Senior Member Chelsea Walsh

Member Dr Ion Alexander

Member Brigadier Conrad Ermert (ret'd)

Member Dr Gordon Hughes

Member Regina Perton OAM

Member Anne Shanahan

Member Brigadier Gerard Warner AM LVO (ret'd)

Member Simon Webb

Cessations

Deputy President the Hon Raymond Groom AO

Deputy President Robin Handley

Deputy President Stanley Hotop

Senior Member Anne Britton

Senior Member Professor Robin Creyke

Senior Member Graham Friedman

Senior Member Graham Kenny

Senior Member Dean Letcher QC

Senior Member Steven Penglis

Senior Member Jan Redfern PSM

Member Dr Roslyn Blakley

Member Dr Janette Chaney

Member Dr Amanda Frazer

Member Dr Hadia Haikal-Mukhtar

Member Kathryn Hogan

Member Mark Hyman

Member Professor Graham Johnston AM

Member Brigadier Dr Graham Maynard (ret'd)

Member Dr Roderick McRae

Member Professor Peter Reilly AO

Member Professor Tania Sourdin

Member Peter Wulf

Appendix // 02 Staff of the AAT

Table A2.1 Employment by registry, 30 June 2015

|

Classification

|

Registries

|

|

Sydney

|

Melbourne

|

Brisbane

|

Adelaide

|

Perth

|

Hobart

|

Canberra

|

Principal Registry

|

Total

|

| APS Level 2 |

–

|

–

|

6

|

–

|

4

|

–

|

–

|

–

|

10

|

| AAT Broadband 3/4 |

19

|

14

|

15

|

9

|

6

|

2

|

8

|

5

|

78

|

| APS Level 5 |

–

|

1

|

–

|

–

|

–

|

–

|

–

|

7

|

8

|

| APS Level 6 |

2

|

2

|

1

|

1

|

1

|

–

|

1

|

14

|

22

|

| Executive Level 1 |

–

|

–

|

–

|

–

|

–

|

–

|

–

|

12

|

12

|

| Executive Level 2 |

5

|

4

|

3

|

3

|

3

|

–

|

3

|

4

|

25

|

| SES Band 1 |

–

|

–

|

–

|

–

|

–

|

–

|

–

|

2

|

2

|

| Total |

26

|

21

|

25

|

13

|

14

|

2

|

12

|

44

|

157

|

There were no staff at APS Level 1.

These figures include all full-time and part-time ongoing and non-ongoing staff, including 25 staff employed for irregular or intermittent duties. Staff on long-term leave are not included. If they have been replaced, the replacement staff are included.

Principal Registry staff were based in Sydney (20), Melbourne (1), Brisbane (16), Adelaide (1), Perth (2), Hobart (3) and Canberra (1).

Table A2.2 Equal employment opportunity data, 30 June 2015

|

Classification

|

Total staff

|

Women

|

Men

|

A&TSI

|

NESB

|

PWD

|

| APS Level 2 |

10

|

8

|

2

|

–

|

–

|

–

|

| AAT Broadband 3/4 |

78

|

54

|

24

|

1

|

24

|

3

|

| APS Level 5 |

8

|

5

|

3

|

–

|

2

|

–

|

| APS Level 6 |

22

|

13

|

9

|

–

|

6

|

–

|

| Executive Level 1 |

12

|

4

|

8

|

–

|

6

|

–

|

| Executive Level 2 |

25

|

19

|

6

|

–

|

6

|

–

|

| SES Band 1 |

2

|

1

|

1

|

–

|

–

|

–

|

| Total |

157

|

104

|

53

|

1

|

44

|

3

|

A&TSI Aboriginal and Torres Strait Islanders

NESB People of non-English-speaking background

PWD People with disability

The data in this table is based, in part, on information voluntarily provided by staff

Table A2.3 Employment status and arrangements, 30 June 2015

| |

Employment status

|

|

Employment arrangements

|

|

Classification

|

Salary range

|

Full-time

|

Part-time

|

Irregular/ Intermittent

|

Total

|

Enterprise Agreement

|

Individual Flexibility Arrangement

|

Section 24(1) Determination

|

| APS Level 1 |

$42,745 – 47,240 |

–

|

–

|

–

|

–

|

–

|

–

|

–

|

| APS Level 2 |

$48,374 – 54,419 |

–

|

–

|

10

|

10

|

10

|

–

|

–

|

| AAT Broadband 3/4 |

$57,282 – 66,675 |

63

|

5

|

10

|

78

|

78

|

–

|

–

|

| APS Level 5 |

$68,491 – 72,629 |

8

|

–

|

–

|

8

|

8

|

–

|

–

|

| APS Level 6 |

$74,196 – 84,975 |

16

|

3

|

3

|

22

|

22

|

–

|

–

|

| Executive Level 1 |

$93,976 – 110,611 |

11

|

1

|

–

|

12

|

12

|

3

|

–

|

| Executive Level 2 |

$112,527 – 127,929 |

15

|

8

|

2

|

25

|

25

|

2

|

–

|

| SES Band 1 |

$126,686 – 145,259 |

2

|

–

|

–

|

2

|

1

|

–

|

1

|

| Total |

|

115

|

17

|

25

|

157

|

156a

|

5a

|

1

|

a Note: The three Executive Level 1 and two Executive Level 2 staff with Individual Flexibility Arrangements were covered by the AAT's enterprise agreement.

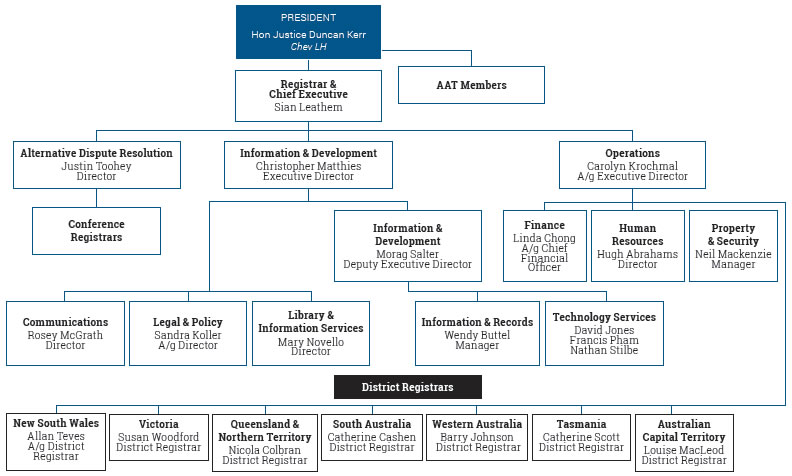

Figure A2.4 Administrative structure of the AAT, 30 June 2015

Appendix // 03 AAT jurisdiction

This appendix lists the laws — the Acts and legislative instruments — under which decisions could be made that were subject to review by the AAT as at 30 June 2015. The list does not include laws that were assented to or made in the reporting period but had not commenced at 30 June 2015.

The laws listed in bold conferred new jurisdiction on the Tribunal to review decisions made under that enactment.

Commonwealth laws

A New Tax System (Australian Business Number) Act 1999

A New Tax System (Family Assistance) Act 1999

A New Tax System (Family Assistance) (Administration) Act 1999

A New Tax System (Goods and Services Tax) Act 1999

A New Tax System (Goods and Services Tax) Regulations 1999

A New Tax System (Goods and Services Tax Transition) Act 1999

A New Tax System (Wine Equalisation Tax) Act 1999

Aboriginal and Torres Strait Islander Act 2005

Aboriginal and Torres Strait Islander Commission Amendment Act 2005

Adelaide Airport Curfew Act 2000

Administrative Appeals Tribunal Act 1975

Administrative Appeals Tribunal Regulations 1976

Adult Disability Assessment Determination 1999

Age Discrimination Act 2004

Aged Care Act 1997

Aged Care (Transitional Provisions) Act 1997

Agricultural and Veterinary Chemical Products (Collection of Levy) Act 1994

Agricultural and Veterinary Chemicals (Administration) Act 1992

Agricultural and Veterinary Chemicals (Administration) Regulations 1995

Agricultural and Veterinary Chemicals Code Act 1994

Agricultural and Veterinary Chemicals Code Regulations 1995

Air Navigation Act 1920

Air Navigation (Aircraft Engine Emissions) Regulations

Air Navigation (Aircraft Noise) Regulations 1984

Air Navigation (Aviation Security Status Checking) Regulations 2004

Air Navigation (Coolangatta Airport Curfew) Regulations 1999

Air Navigation (Essendon Airport) Regulations 2001

Air Navigation (Fuel Spillage) Regulations 1999

Air Navigation Regulations 1947

Air Services Act 1995

Air Services Regulations 1995

Aircraft Noise Levy Collection Act 1995

Airports Act 1996

Airports (Building Control) Regulations 1996

Airports (Control of On-Airport Activities) Regulations 1997

Airports (Environment Protection) Regulations 1997

Airports (Ownership – Interests in Shares) Regulations 1996

Airports (Protection of Airspace) Regulations 1996

Airports Regulations 1997

Antarctic Marine Living Resources Conservation Act 1981

Antarctic Marine Living Resources Conservation Regulations 1994

Antarctic Treaty (Environment Protection) Act 1980

Anti-Money Laundering and Counter-Terrorism Financing Act 2006

Archives Act 1983

AusCheck Regulations 2007

Australian Charities and Not-for-profits Commission Act 2012

Australian Citizenship Act 2007

Australian Education Act 2013

Australian Grape and Wine Authority Act 2013

Australia Grape and Wine Authority Regulations 1981

Australian Hearing Services Act 1991

Australian Jobs Act 2013

Australian Meat and Live-stock Industry Act 1997

Australian Meat and Live-stock Industry (Beef Export to the USA—Quota Years 2015–2021) Order 2014

Australian Meat and Live-stock Industry (Export Licensing) Regulations 1998

Australian National Registry of Emissions Units Act 2011

Australian Participants in British Nuclear Tests (Treatment) Act 2006

Australian Passports Act 2005

Australian Passports (Application Fees) Act 2005

Australian Passports Determination 2005

Australian Postal Corporation Regulations 1996

Australian Radiation Protection and Nuclear Safety Act 1998

Australian Radiation Protection and Nuclear Safety Regulations 1999

Australian Securities and Investments Commission Act 2001

Australian Security Intelligence Organisation Act 1979

Australian Sports Anti-Doping Authority Regulations 2006

Australian Transaction Reports and Analysis Centre Supervisory Cost Recovery Levy (Collection) Act 2011

Automotive Transformation Scheme Regulations 2010

Aviation Transport Security Act 2004

Aviation Transport Security Regulations 2005

Banking Act 1959

Bankruptcy Act 1966

Bankruptcy Regulations 1996

Biological Control Act 1984

Broadcasting Services Act 1992

Building Energy Efficiency Disclosure Act 2010

Business Names Registration Act 2011

Business Names Registration (Transitional and Consequential Provisions) Act 2011

Carbon Credits (Carbon Farming Initiative) Act 2011

Chemical Weapons (Prohibition) Act 1994

Child Care Benefit (Eligibility of Child Care Services for Approval and Continued Approval) Determination 2000

Child Disability Assessment Determination 2001

Child Support (Assessment) Act 1989

Child Support (Registration and Collection) Act 1988

City Area Leases Ordinance 1936

Civil Aviation Act 1988

Civil Aviation (Buildings Control) Regulations 1988

Civil Aviation Regulations 1988

Civil Aviation Safety Regulations 1998

Classification (Publications, Films and Computer Games) Act 1995

Clean Energy Advances for Approved Care Organisations Administrative Scheme Determination 2012

Clean Energy Legislation (Carbon Tax Repeal) Act 2014

Clothing and Household Textile (Building Innovative Capability) Scheme 2010

Coal Mining Industry (Long Service Leave) Payroll Levy Collection Act 1992

Coastal Trading (Revitalising Australian Shipping) Act 2012

Commerce (Trade Descriptions) Act 1905

Commercial Television Conversion Scheme 1999

Commonwealth Electoral Act 1918

Compensation (Japanese Internment) Act 2001

Competition and Consumer Act 2010

Continence Aids Payment Scheme 2010

Copyright Act 1968

Copyright Regulations 1969

Corporations Act 2001

Corporations (Aboriginal and Torres Strait Islander) Act 2006

Criminal Code Act 1995

Cultural Bequests Program Guidelines (No. 1) 1997

Customs Act 1901

Customs (International Obligations) Regulation 2015

Customs (Prohibited Exports) Regulations 1958

Customs (Prohibited Imports) Regulations 1956

Customs Tariff Act 1995

Dairy Adjustment Levy Collection Regulations 2000

Dairy Produce Act 1986

Dairy Produce Regulations 1986

Defence Act 1903

Defence (Areas Control) Regulations 1989

Defence Determination 2005/15

Defence Force (Home Loans Assistance) Act 1990

Defence Force Regulations 1952

Defence Force Retirement and Death Benefits Act 1973

Defence Force (Superannuation) (Productivity Benefit) Determination 1988

Defence Home Ownership Assistance Scheme Act 2008

Defence Home Ownership Assistance Scheme Regulations 2008

Defence (Prohibited Words and Letters) Regulations 1957

Defence Reserve Service (Protection) Act 2001

Defence Service Homes Act 1918

Defence Trade Controls Act 2012

Defence Trade Controls Regulation 2013

Designs Act 2003

Designs Regulations 2004

Development Allowance Authority Act 1992

Disability (Access to Premises – Buildings) Standards 2010

Disability Discrimination Act 1992

Disability Services Act 1986

Disability Standards for Accessible Public Transport 2002

Eastern Tuna and Billfish Fishery Management Plan 2010

Education Services for Overseas Students Act 2000

Environment Protection and Biodiversity Conservation Act 1999

Environment Protection and Biodiversity Conservation Regulations 2000

Environment Protection and Management Ordinance 1987

Environment Protection (Sea Dumping) Act 1981

ETR Payments Administrative Scheme (FaHCSIA) Determination 2012

Excise Act 1901

Excise Regulation 2015

Explosives Transport Regulations 2002

Export Charges (Collection) Act 2015

Export Control (Animals) Order 2004

Export Control (Eggs and Egg Products) Orders 2005

Export Control (Fees) Orders 2001

Export Control (Fish and Fish Products) Orders 2005

Export Control (Hardwood Wood Chips) Regulations 1996

Export Control (Meat and Meat Products) Orders 2005

Export Control (Milk and Milk Products) Orders 2005

Export Control (Organic Produce Certification) Orders

Export Control (Plants and Plant Products) Order 2011

Export Control (Poultry Meat and Poultry Meat Products) Orders 2010

Export Control (Prescribed Goods — General) Order 2005

Export Control (Rabbit and Ratite Meat) Orders 1985

Export Control (Unprocessed Wood) Regulations

Export Control (Wild Game Meat and Wild Game Meat Products) Orders 2010

Export Inspection and Meat Charges Collection Act 1985

Export Market Development Grants Act 1997

Fair Entitlements Guarantee Act 2012

Fair Work (Building Industry – Accreditation Scheme) Regulations 2005

Family Assistance Legislation Amendment (Child Care Budget and Other Measures) Act 2008

Family Law (Family Dispute Resolution Practitioners) Regulations 2008

Family Law (Fees) Regulation 2012

Farm Household Support Act 2014

Federal Circuit Court of Australia Act 1999

Federal Court and Federal Circuit Court Regulation 2012

Financial Institutions Supervisory Levies Collection Act 1998

Financial Sector (Business Transfer and Group Restructure) Act 1999

Financial Sector (Collection of Data) Act 2001

First Home Saver Accounts Act 2008

Fisheries Management Act 1991

Food Standards Australia New Zealand Act 1991

Foreign Passports (Law Enforcement and Security) Act 2005

Freedom of Information Act 1982

Fringe Benefits Tax Assessment Act 1986

Fuel Quality Standards Act 2000

Fuel Quality Standards Regulations 2001

Fuel Tax Act 2006

Gene Technology Act 2000

Gene Technology Regulations 2001

Governor-General Act 1974

Great Barrier Reef Marine Park Act 1975

Great Barrier Reef Marine Park (Aquaculture) Regulations 2000

Great Barrier Reef Marine Park Regulations 1983

Greenhouse and Energy Minimum Standards Act 2012

Hazardous Waste (Regulation of Exports and Imports) Act 1989

Hazardous Waste (Regulation of Exports and Imports) (OECD Decision) Regulations 1996

Hazardous Waste (Regulation of Exports and Imports) Regulations 1996

Health and Other Services (Compensation) Act 1995

Healthcare Identifiers Act 2010

Health Insurance Act 1973

Health Insurance (Eligible Collection Centres) Approval Principles 2010

Hearing Service Providers Accreditation Scheme 1997

Hearing Services Administration Act 1997

Hearing Services Rules of Conduct 2012

Hearing Services Voucher Rules 1997

High Court of Australia (Fees) Regulation 2012

Higher Education Funding Act 1988

Higher Education Support Act 2003

Horse Disease Response Levy Collection Act 2011

Horticultural Export Charge Regulations

Horticulture Marketing and Research and Development Services (Export Efficiency) Regulations 2002

Immigration (Guardianship of Children) Act 1946

Imported Food Charges (Collection) Act 2015

Imported Food Control Act 1992

Income Tax Assessment Act 1936

Income Tax Assessment Act 1997

Income Tax Regulations 1936

Income Tax (Transitional Provisions) Act 1997

Industrial Chemicals (Notification and Assessment) Act 1989

Industrial Chemicals (Notification and Assessment) Regulations 1990

Industry Research and Development Act 1986

Insurance Acquisition and Takeovers Act 1991

Insurance Act 1973

Interactive Gambling Act 2001

Interstate Road Transport Act 1985

Interstate Road Transport Regulations 1986

Jervis Bay Territory Emergency Management Ordinance 2015

Judges' Pensions Act 1968

Lands Acquisition Act 1989

Lakes Ordinance 1976

Law Officers Act 1964

Leases Ordinance 1918

Leases (Special Purposes) Ordinance 1925

Life Insurance Act 1995

Liquid Fuel Emergency Act 1984

Major Sporting Events (Indicia and Images) Protection Act 2014

Marine Orders Parts 6, 9, 11, 12, 15, 16, 17, 18, 19, 21, 25, 27, 28, 30, 31, 32, 33, 34, 35, 41, 42, 43, 44, 47, 49, 50, 51, 52, 54, 58, 59, 60, 64, 70, 91, 93, 96, 97, 502, 503, 504, 505, 506 and 507

Marine Safety (Domestic Commercial Vessel) National Law Act 2012

Marine Safety (Domestic Commercial Vessel) National Law Regulation 2013

Maritime Transport and Offshore Facilities Security Act 2003

Maritime Transport and Offshore Facilities Security Regulations 2003

Marriage Act 1961

Meat Export Charge Collection Act 1984

Medibank Private Sale Act 2006

Medical Indemnity Act 2002

Medical Indemnity (Prudential Supervision and Product Standards) Act 2003

Midwife Professional Indemnity (Commonwealth Contribution) Scheme Act 2010

Migration Act 1958

Military Rehabilitation and Compensation Act 2004

Military Rehabilitation and Compensation Act Education and Training Scheme 2004

Motor Vehicle Compensation Scheme 2004

Motor Vehicle Standards Act 1989

Motor Vehicle Standards Regulations 1989

Mutual Recognition Act 1992

Narcotic Drugs Act 1967

National Consumer Credit Protection Act 2009

National Consumer Credit Protection Regulations 2010

National Disability Insurance Scheme Act 2013

National Environment Protection Measures (Implementation) Act 1998

National Greenhouse and Energy Reporting Act 2007

National Greenhouse and Energy Reporting Regulations 2008

National Health Act 1953

National Health (Pharmaceuticals and Vaccines – Cost Recovery) Regulations 2009

National Health (Pharmaceutical Benefits) Regulations 1960

National Health Security Act 2007

National Library Regulations 1994

National Measurement Act 1960

National Measurement Regulations 1999

National Rental Affordability Scheme Regulations 2008

National Television Conversion Scheme 1999

National Vocational Education and Training Regulator Act 2011

National Vocational Education and Training Regulator (Transitional Provisions) Act 2011

Native Title (Prescribed Bodies Corporate) Regulations 1999

Native Title (Tribunal) Regulations 1993

Navigation Act 2012

Northern Prawn Fishery Management Plan 1995

Nuclear Non-Proliferation (Safeguards) Act 1987

Occupational Health and Safety (Maritime Industry) (National Standards) Regulations 2003

Offshore Minerals Act 1994

Offshore Petroleum and Greenhouse Gas Storage Act 2006

Offshore Petroleum and Greenhouse Gas Storage (Resource Management and Administration) Regulations 2011

Ombudsman Act 1976

Ozone Protection and Synthetic Greenhouse Gas Management Act 1989

Ozone Protection and Synthetic Greenhouse Gas Management Regulations 1995

Paid Parental Leave Act 2010

Papua New Guinea (Members of the Forces Benefits) Regulations 1961

Papua New Guinea (Staffing Assistance) Act 1973

Parliamentary Contributory Superannuation Act 1948

Patents Act 1990

Patents Regulations 1991

Personal Property Securities Act 2009

Personally Controlled Electronic Health Records Act 2012

Petroleum Excise (Prices) Act 1987

Petroleum Resource Rent Tax Assessment Act 1987

Petroleum Resource Rent Tax Assessment Regulations 2005

Pig Industry Act 2001

Plant Breeder's Rights Act 1994

Plant Breeder's Rights Regulations 1994

Pooled Development Funds Act 1992

Premium Support (Medical Indemnity Provider) Scheme 2006

Primary Industries (Customs) Charges Act 1999

Primary Industries (Excise) Levies Act 1999

Primary Industries Levies and Charges Collection Act 1991

Primary Industries Levies and Charges Collection Regulations 1991

Primary Industries Levies and Charges (National Residue Survey Levies) Regulations 1998

Privacy Act 1988

Private Health Insurance Act 2007

Product Grants and Benefits Administration Act 2000

Product Stewardship Act 2011

Product Stewardship (Voluntary Arrangements) Instrument 2012

Protection of Cultural Objects on Loan Act 2013

Protection of Movable Cultural Heritage Act 1986

Protection of the Sea (Civil Liability) Act 1981

Protection of the Sea (Civil Liability for Bunker Oil Pollution Damage) Act 2008

Public Lending Right Act 1985

Quality Agency Principles 2013

Radiocommunications Act 1992

Radiocommunications (Spectrum Licence Allocation) Determination 2000

Radiocommunications (Spectrum Licence Allocation – 2 GHz Band) Determination 2000

Radiocommunications Taxes Collection (Penalties on Unpaid Tax) Determination 2015

Radiocommunications (Trading Rules for Spectrum Licences) Determination 2012

Registration of Deaths Abroad Act 1984

Renewable Energy (Electricity) Act 2000

Renewable Energy (Electricity) Amendment (Transitional Provision) Regulations 2010

Renewable Energy (Electricity) Regulations 2001

Resale Royalty Right for Visual Artists Act 2009

Research Involving Human Embryos Act 2002

Retirement Savings Accounts Act 1997

Retirement Savings Accounts Regulations 1997

Roads and Public Places Ordinance 1937

Safety, Rehabilitation and Compensation Act 1988

Sanctions Principles 2014

Sea Installations Act 1987

Seafarers Rehabilitation and Compensation Act 1992

Sex Discrimination Act 1984

Shipping Reform (Tax Incentives) Act 2012

Shipping Registration Act 1981

Small Superannuation Accounts Act 1995

Social Security Act 1991

Social Security (Administration) Act 1999

Social Security and Veterans' Affairs Legislation Amendment (One-Off Payments and Other 2007 Budget Measures) Act 2007

Social Security (International Agreements) Act 1999

Social Security (Pension Valuation Factor) Determination 1998

Southern Bluefin Tuna Fishery Management Plan 1995

Southern Squid Jig Fishery Management Plan 2005

Space Activities Act 1998

Space Activities Regulations 2001

Stronger Futures in the Northern Territory Act 2012

Student Assistance Act 1973

Student Identifiers Act 2014

Superannuation Act 1922

Superannuation Contributions Tax (Assessment and Collection) Act 1997

Superannuation Contributions Tax (Members of Constitutionally Protected Superannuation Funds) Assessment and Collection Act 1997

Superannuation Guarantee (Administration) Act 1992

Superannuation Industry (Supervision) Act 1993

Superannuation Industry (Supervision) Regulations 1994

Superannuation (Self Managed Superannuation Funds) Taxation Act 1987

Superannuation (Unclaimed Money and Lost Members) Act 1999

Sydney Airport Curfew Act 1995

Sydney Harbour Federation Trust Regulations 2001

Tax Agent Services Act 2009

Tax Agent Services Regulations 2009

Taxation Administration Act 1953

Taxation Administration Regulations 1976

Telecommunications Act 1997

Telecommunications (Annual Numbering Charge – Late Payment Penalty) Determination 2000

Telecommunications (Consumer Protection and Service Standards) Act 1999

Telecommunications (Eligible Revenue) Determination 2015

Telecommunications (Freephone and Local Rate Numbers) Allocation Determination 2007 (No. 1)

Telecommunications Integrated Public Number Database Scheme 2007

Telecommunications Numbering Plan 1997

Telecommunications (Service Provider – Identity Checks for Prepaid Mobile Carriage Services) Determination 2013

Telecommunications Service Provider (Mobile Premium Services) Determination 2010 (No. 1)

Telecommunications Service Provider (Mobile Premium Services) Determination 2010 (No. 2)

Telecommunications Universal Service Management Agency Act 2012

Telecommunications Universal Service Management Agency (Eligible Revenue) Determination 2013

Television Licence Fees Regulations 1990

Telstra Corporation Act 1991

Termination Payments Tax (Assessment and Collection) Act 1997

Tertiary Education Quality and Standards Agency Act 2011

Tertiary Education Quality and Standards Agency (Consequential Amendments and Transitional Provisions) Act 2011

Textile, Clothing and Footwear Post–2005 Strategic Investment Program Scheme 2005

Textile, Clothing and Footwear Strategic Investment Program Scheme 1999

Therapeutic Goods Act 1989

Therapeutic Goods (Medical Devices) Regulations 2002

Therapeutic Goods Regulations 1990

Tobacco Advertising Prohibition Act 1992

Trade Marks Act 1995

Trade Marks Regulations 1995

Trade Practices (Consumer Product Information Standards) (Cosmetics) Regulations 1991

Trade Support Loans Act 2014

Tradespersons' Rights Regulation Act 1946

Tradex Scheme Act 1999

Trans-Tasman Mutual Recognition Act 1997

Trust Recoupment Tax Assessment Act 1985

Venture Capital Act 2002

Veterans' Entitlements Act 1986

Veterans' Entitlements (Clarke Review) Act 2004

Veterans' Entitlements Regulations 1986

Veterans' Entitlements (Rehabilitation Allowance) Regulations

Veterans' Entitlements (Special Assistance — Motorcycle Purchase) Regulations 2001

Veterans' Entitlements (Special Assistance) Regulations 1999

Veterans' Vocational Rehabilitation Scheme

Water Act 2007

Water Efficiency Labelling and Standards Act 2005 (ACT)

Water Efficiency Labelling and Standards Act 2005 (Cth)

Water Efficiency Labelling and Standards Act 2005 (Qld)

Water Efficiency Labelling and Standards Act 2005 (Tas)

Water Efficiency Labelling and Standards Act 2005 (Vic)

Water Efficiency Labelling and Standards Act 2006 (NT)

Water Efficiency Labelling and Standards Act 2006 (WA)

Water Efficiency Labelling and Standards Determination 2013

Water Efficiency Labelling and Standards (New South Wales) Act 2006 (NSW)

Work Health and Safety Regulations 2011

Norfolk Island laws

Absentee Landowners Levy Act 1976

Animals (Importation) Act 1983

Apiaries Act 1935

Associations Incorporation Act 2005

Birds Protection Act 1913

Bookmakers and Betting Exchange Act 1998

Brands and Marks Act 1949

Building Act 2002

Business Names Act 1976

Business Transactions (Administration) Act 2006

Business Transactions (Levy Imposition) Act 2006

Companies Act 1985

Crown Lands Act 1996

Customs Act 1913

Electricity (Licensing and Registration) Act 1985

Environment Act 1990

Financial Institutions Levy Act 1985

Fuel Levy Act 1987

Goods and Services Tax Act 2007

Healthcare Levy Act 1990

Land Administration Fees Act 1996

Land Titles Act 1996

Land Valuation Act 2012

Liquor Act 2005

Lotteries and Fundraising Act 1987

Medical Practitioners Registration Act 1983

Migratory Birds Act 1980

Norfolk Island Broadcasting Act 2001

Norfolk Island National Park and Norfolk Island Botanic Garden Act 1984

Planning Act 2002

Public Health Act 1996

Public Reserves Act 1997

Roads Act 2002

Social Services Act 1980

Subdivision Act 2002

Telecommunications Act 1992

Tourist Accommodation Act 1984

Tourist Accommodation (Ownership) Act 1989

Trees Act 1997

Appendix // 04 Applications, outcomes, listings and appeals statistics

|

Table or Chart

|

Title

|

| A4.1 |

Applications lodged and applications finalised in 2014–15 |

| A4.2 |

Applications lodged – By state and territory |

| A4.3 |

Applications finalised – By state and territory |

| A4.4 |

Percentage of applications finalised without a hearing |

| A4.5 |

Outcomes of applications for review of a decision finalised in 2014–15 |

| A4.6 |

Applications current at 30 June 2015 – By state and territory |

| A4.7 |

Alternative dispute resolution processes, interlocutory hearings and hearings conducted by the AAT |

| A4.8 |

Constitution of tribunals for hearings |

| A4.9 |

Appeals against decisions of the AAT by jurisdiction |

| A4.10 |

Outcomes of appeals against AAT decisions – By jurisdiction |

Table A4.1 Applications lodged and applications finalised, 2014–15

| |

Applications lodged

|

Applications finalised

|

|

No

|

%

|

No

|

%

|

| Applications for review of decisions — major jurisdictions |

| National Disability Insurance Scheme |

| Eligibility to access scheme |

8

|

|

10

|

|

| Review of supports in participant plan |

10

|

|

8

|

|

| Subtotal |

18

|

< 1

|

18

|

< 1

|

| Social Security |

| Age pension/Pension bonus scheme |

176

|

|

146

|

|

| Austudy payment |

12

|

|

11

|

|

| Carer allowance and carer payment |

74

|

|

61

|

|

| Compensation preclusion period |

64

|

|

68

|

|

| Disability support pension |

1,253

|

|

1,108

|

|

| Family tax benefit |

94

|

|

62

|

|

| Newstart allowance |

104

|

|

100

|

|

| Overpayments and debt recovery |

440

|

|

454

|

|

| Parenting payment |

18

|

|

27

|

|

| Rent assistance |

12

|

|

11

|

|

| Special benefit |

11

|

|

11

|

|

| Youth allowance |

18

|

|

17

|

|

| Other |

44

|

|

53

|

|

| Subtotal |

2,320

|

35

|

2,129

|

32

|

| Veterans' Affairs |

| Military Rehabilitation and Compensation Act 2004 |

72

|

|

61

|

|

| Veterans' Entitlements Act 1986 |

|

|

|

|

| Disability pension |

229

|

|

225

|

|

| Service pension/Income support supplement/ Pension bonus |

38

|

|

30

|

|

| Widows pension |

44

|

|

57

|

|

| Other |

8

|

|

6

|

|

| Subtotal |

391

|

6

|

379

|

6

|

| Workers' Compensation |

| Safety, Rehabilitation and Compensation Act 1988, by decision-maker |

|

| Asciano Services |

7

|

|

15

|

|

| Australian Air Express Pty Limited |

11

|

|

7

|

|

| Australian Postal Corporation |

294

|

|

302

|

|

| BIS Industries Limited |

12

|

|

7

|

|

| Comcare |

569

|

|

485

|

|

| Commonwealth Bank of Australia and related companies |

27

|

|

27

|

|

| John Holland Group Pty Limited and related companies |

21

|

|

16

|

|

| K & S Freighters Pty Limited |

26

|

|

33

|

|

| Linfox Armaguard Pty Limited/Linfox Australia Pty Limited |

94

|

|

88

|

|

| Military Rehabilitation and Compensation Commission |

105

|

|

113

|

|

| National Australia Bank Limited/National Wealth Management Services Limited |

28

|

|

32

|

|

| Optus Administration Pty Limited |

9

|

|

12

|

|

| Prosegur Australia Pty Limited |

19

|

|

7

|

|

| Telstra Corporation Limited |

81

|

|

97

|

|

| TNT Australia Pty Limited |

38

|

|

23

|

|

| Transpacific Industries Pty Limited |

49

|

|

34

|

|

| Other decision-makers |

25

|

|

31

|

|

| Seafarers Rehabilitation and Compensation Act 1992 |

83

|

|

89

|

|

| Subtotal |

1,498

|

23

|

1,418

|

21

|

| Taxation |

| Taxation Appeals Division |

| Excess contributions tax |

8

|

|

15

|

|

| Fringe benefits tax |

13

|

|

13

|

|

| Goods and services tax |

97

|

|

112

|

|

| Income tax (other than tax schemes) |

727

|

|

1,153

|

|

| Income tax (tax schemes) |

1

|

|

1

|

|

| Private rulings |

8

|

|

31

|

|

| Superannuation guarantee charge |

12

|

|

32

|

|

| Taxation administration |

5

|

|

8

|

|

| Other |

25

|

|

20

|

|

| Subtotal |

896

|

14

|

1,385

|

21

|

| Small Taxation Claims Tribunal |

|

|

|

|

| Goods and services tax |

2

|

|

4

|

|

| Income tax |

62

|

|

80

|

|

| Refusal of extension of time to lodge objection |

23

|

|

21

|

|

| Release from taxation liabilities |

67

|

|

71

|

|

| Superannuation contributions surcharge |

0

|

|

16

|

|

| Other |

5

|

|

5

|

|

| Subtotal |

159

|

2

|

197

|

3

|

| Subtotal |

1,055

|

16

|

1,582

|

23

|

| SUBTOTAL FOR MAJOR JURISDICTIONS |

5,282

|

81

|

5,526

|

82

|

| |

| Applications for review of decisions — by portfolio |

| Agriculture |

| Agricultural and veterinary chemicals |

3

|

|

8

|

|

| Fisheries |

1

|

|

0

|

|

| Research participation certificates for Conservation Tillage Refundable Tax Offset |

2

|

|

2

|

|

| Subtotal |

6

|

< 1

|

10

|

< 1

|

| Attorney-Generals's |

| Anti-money laundering and counter-terrorism financing |

1

|

|

1

|

|

| Background checking |

4

|

|

3

|

|

| Bankruptcy |

26

|

|

25

|

|

| Human rights |

1

|

|

1

|

|

| Marriage celebrants |

24

|

|

22

|

|

| Personal property securities |

6

|

|

1

|

|

| Privacy |

4

|

|

0

|

|

| Tax offset for films |

1

|

|

1

|

|

| Waiver of fees in courts |

1

|

|

1

|

|

| Subtotal |

68

|

1

|

55

|

< 1

|

| Communications |

|

|

|

|

| Communications and media |

1

|

|

1

|

|

| Subtotal |

1

|

< 1

|

1

|

< 1

|

| Defence |

|

|

|

|

| Defence Force retirement and death benefits |

3

|

|

6

|

|

| Other |

2

|

|

2

|

|

| Subtotal |

5

|

< 1

|

8

|

< 1

|

| Education and Training |

| Education services for overseas students |

9

|

|

12

|

|

| Higher Education Loan Program |

48

|

|

46

|

|

| Mutual recognition of occupations |

10

|

|

10

|

|

| National vocational education and training regulation |

36

|

|

32

|

|

| Tertiary education quality and standards |

8

|

|

7

|

|

| Trade support loans |

1

|

|

1

|

|

| Subtotal |

112

|

2

|

108

|

2

|

| Employment |

| Fair entitlements guarantee |

29

|

|

17

|

|

| Subtotal |

29

|

< 1

|

17

|

< 1

|

| Environment |

| Clean energy regulation |

1

|

|

3

|

|

| Environment protection and biodiversity |

2

|

|

2

|

|

| Great Barrier Reef Marine Park |

2

|

|

2

|

|

| Hazardous waste |

2

|

|

0

|

|

| Ozone protection and synthetic greenhouse gas management |

1

|

|

1

|

|

| Sydney Harbour Federation Trust |

1

|

|

1

|

|

| Subtotal |

9

|

< 1

|

9

|

< 1

|

| Finance |

| Electoral matters |

2

|

|

3

|

|

| Subtotal |

2

|

< 1

|

3

|

< 1

|

| Foreign Affairs and Trade |

| Export market development grants |

2

|

|

5

|

|

| Passports |

20

|

|

18

|

|

| Subtotal |

22

|

< 1

|

23

|

< 1

|

| Health |

| Industrial chemicals |

1

|

|

2

|

|

| Medicare |

1

|

|

2

|

|

| Pharmacists |

12

|

|

13

|

|

| Sports anti-doping |

0

|

|

3

|

|

| Therapeutic goods |

7

|

|

9

|

|

| Subtotal |

21

|

< 1

|

29

|

< 1

|

| Immigration and Border Protection |

| Citizenship |

324

|

|

290

|

|

| Customs |

31

|

|

31

|

|

| Migration agent registration |

10

|

|

4

|

|

| Protection visa cancellation or refusal |

3

|

|

6

|

|

| Visa cancellation or refusal on character grounds |

6

|

|

5

|

|

| Subtotal |

374

|

6

|

336

|

5

|

| Industry and Science |

| Automotive industry |

0

|

|

1

|

|

| Industry research and development |

14

|

|

4

|

|

| Patents, designs and trade marks |

3

|

|

2

|

|

| Subtotal |

17

|

< 1

|

7

|

< 1

|

| Infrastructure and Regional Development |

| Airports |

1

|

|

2

|

|

| Aviation and maritime transport security |

1

|

|

2

|

|

| Civil aviation |

28

|

|

47

|

|

| Coastal trading |

0

|

|

1

|

|

| Maritime safety |

4

|

|

3

|

|

| Motor vehicle standards |

12

|

|

10

|

|

| National land decisions |

0

|

|

1

|

|

| Subtotal |

46

|

1

|

66

|

< 1

|

| Social Services |

| Aged care |

26

|

|

38

|

|

| Child care services |

5

|

|

3

|

|

| Child support – percentage of care review |

35

|

|

27

|

|

| Child support – review of SSAT refusal to extend time |

10

|

|

9

|

|

| Child support – other |

12

|

|

16

|

|

| Disability services |

0

|

|

1

|

|

| Paid parental leave |

16

|

|

14

|

|

| Subtotal |

104

|

2

|

108

|

2

|

| Treasury |

| Auditors and liquidators registration |

2

|

|

2

|

|

| Business names registration |

23

|

|

18

|

|

| Charities and not-for-profit entities |

1

|

|

1

|

|

| Consumer credit |

3

|

|

1

|

|

| Corporations and financial services |

32

|

|

20

|

|

| Insurance and superannuation |

3

|

|

4

|

|

| Tax agent registration |

24

|

|

17

|

|

| Subtotal |

88

|

1

|

63

|

< 1

|

| Subtotal for portfolios |

904

|

14

|

843

|

12

|

| |

| Applications for review of decisions — other security appeals |

| Security appeals |

| ASIO security assessments |

11

|

|

8

|

|

| Decisions of National Archives of Australia relating to ASIO records |

0

|

|

1

|

|

| Subtotal |

11

|

< 1

|

9

|

< 1

|

| Whole of Government |

| Archives Act 1983 |

25

|

|

15

|

|

| Freedom of Information Act 1982 |

64

|

|

53

|

|

| Subtotal |

89

|

1

|

68

|

1

|

| Jurisdiction and tribunal decisions |

| Decisions not subject to review by the Tribunal |

155

|

|

162

|

|

| Review of decisions relating to fees |

1

|

|

1

|

|

| Subtotal |

156

|

2

|

163

|

2

|

| Subtotal for other |

256

|

4

|

240

|

4

|

| |

|

|

|

|

| Applications — other, administrative appeals tribunal act |

| Applications for extension of time to lodge an application for review of a decision |

138

|

|

139

|

|

| Applications under the AAT Act relating to a finalised case |

1

|

|

0

|

|

| Subtotal |

139

|

2

|

139

|

|

| |

|

|

|

|

| Applications — Norfolk Island |

|

|

|

|

| |

0

|

|

0

|

|

| Subtotal |

0

|

0

|

0

|

|

| |

|

|

|

|

| Totala |

6,581

|

100

|

6,748

|

100

|

a Percentages do not total 100% due to rounding.

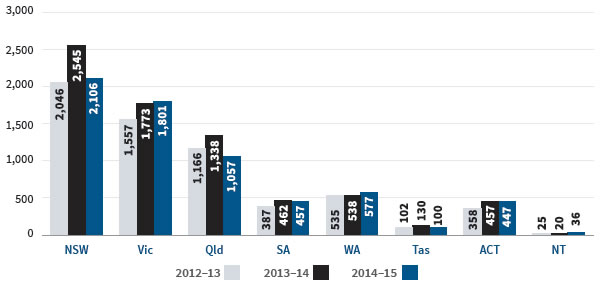

Chart A4.2 Applications lodged – By state and territory

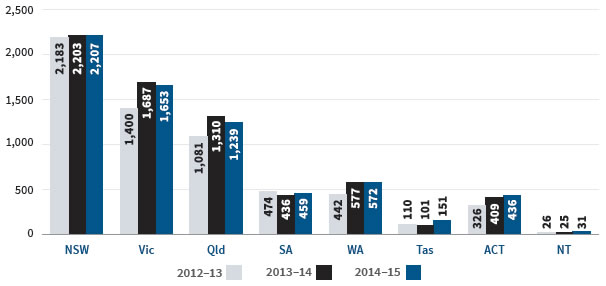

Chart A4.3 Applications finalised – By state and territory

Table A4.4 Percentage of applications finalised without a hearinga

|

Jurisdiction

|

2012–13

%

|

2013–14

%

|

2014–15

%

|

| All |

79

|

82

|

80

|

| Social security |

76

|

77

|

77

|

| Veterans' affairs |

71

|

72

|

67

|

| Workers' compensation |

87

|

86

|

86

|

| Taxation |

|

|

|

| Taxation Appeals Division |

85

|

87

|

82

|

| Small Taxation Claims Tribunal |

63b

|

86

|

83

|

a Applications finalised by the AAT without it completing the review and giving a decision on the merits under section 43 of the Administration Appeals Tribunal Act 1975. Includes applications finalised in accordance with terms of agreement lodged by the parties (sections 34D and 42C), applications withdrawn by the applicant (section 42A(1A)) and applications dismissed by the Tribunal (sections 42A and 42B).

b The figure for the percentage of applications finalised without a hearing in the STCT in 2012–13 differs from the figure that appeared in the 2012–13 and 2013–14 annual reports as a result of a clerical error.

Table A4.5 Outcomes of applications for review of a decision finalised in 2014–15

| |

All applications

|

Social security

|

Veterans' affairs

|

Workers' compensation

|

Taxation

|

|

Taxation Appeals Division

|

Small Taxation Claims Tribunal

|

|

No

|

%

|

No

|

%

|

No

|

%

|

No

|

%

|

No

|

%

|

No

|

%

|

| By consent or withdrawn |

| Decision affirmeda |

458

|

7

|

10

|

< 1

|

2

|

< 1

|

432

|

30

|

8

|

< 1

|

1

|

< 1

|

| Decision varieda |

492

|

7

|

26

|

1

|

34

|

9

|

64

|

5

|

324

|

23

|

39

|

20

|

| Decision set asidea |

1,165

|

18

|

273

|

13

|

79

|

21

|

324

|

23

|

299

|

22

|

37

|

19

|

| Dismissed by consentb |

90

|

1

|

30

|

1

|

3

|

1

|

7

|

< 1

|

36

|

3

|

3

|

2

|

| Dismissed by operation of lawc |

282

|

4

|

282

|

13

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

0

|

| Withdrawn by applicant |

2,015

|

30

|

734

|

34

|

126

|

33

|

344

|

24

|

384

|

28

|

65

|

33

|

| Subtotal |

4,502

|

68

|

1,355

|

64

|

244

|

64

|

1,171

|

83

|

1,051

|

76

|

145

|

74

|

| By decision |

| Decision affirmedd |

1,017

|

15

|

420

|

20

|

74

|

20

|

138

|

10

|

189

|

14

|

29

|

15

|

| Decision variedd |

51

|

< 1

|

9

|

< 1

|

8

|

2

|

9

|

< 1

|

18

|

1

|

0

|

0

|

| Decision set asided |

274

|

4

|

54

|

3

|

43

|

11

|

58

|

4

|

46

|

3

|

4

|

2

|

| Subtotal |

1,342

|

20

|

483

|

23

|

125

|

33

|

205

|

14

|

253

|

18

|

33

|

17

|

| Other |

| Dismissed by Tribunale |

228

|

3

|

117

|

5

|

5

|

1

|

20

|

1

|

39

|

3

|

5

|

3

|

| No jurisdictionf |

271

|

4

|

42

|

2

|

4

|

1

|

18

|

1

|

19

|

1

|

6

|

3

|

| Extension of time refused |

147

|

2

|

116

|

5

|

0

|

0

|

4

|

< 1

|

3

|

< 1

|

1

|

< 1

|

| No application fee paid |

84

|

1

|

0

|

0

|

0

|

0

|

0

|

0

|

17

|

1

|

0

|

0

|

| Otherg |

35

|

< 1

|

16

|

< 1

|

1

|

< 1

|

0

|

0

|

3

|

< 1

|

7

|

4

|

| Subtotal |

765

|

12

|

291

|

14

|

10

|

3

|

42

|

3

|

81

|

6

|

19

|

10

|

| Totalh |

6,609

|

100

|

2,129

|

100

|

379

|

100

|

1,418

|

100

|

1,385

|

100

|

197

|

100

|

a Applications finalised by the AAT in accordance with terms of agreement reached by the parties either in the course of an alternative dispute resolution process (section 34D of the Administrative Appeals Tribunal Act 1975) or at any stage of review proceedings (section 42C).

b Applications dismissed by consent under section 42A(1).

c If an application in the family assistance and social security area relates to the recovery of a debt, the parties may agree in writing to settle the proceedings. On receipt of the agreement, the application is taken to have been dismissed.

d Applications finalised by a decision of the AAT under section 43.

e Applications dismissed under section 42A(2) (non-appearance at a case event), section 42A(5) (failure to proceed with an application or to comply with a direction of the AAT) and section 42B(1) (application is frivolous or vexatious).

f Applications in relation to which the AAT determined it does not have jurisdiction or that were dismissed under section 42A(4) on the basis the applicant failed to demonstrate that a decision was reviewable.

g Includes applications for review of a decision that were lodged out of time and in relation to which no extension of time application was subsequently received.

h Percentages do not total 100% due to rounding.

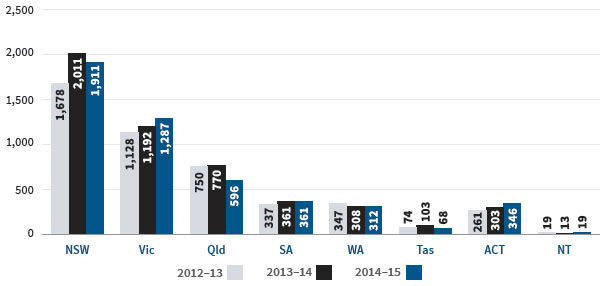

Chart A4.6 Applications current at 30 June 2015 – By state and territory

Table A4.7 Alternative dispute resolution processes, interlocutory hearings and hearings conducted by the AAT

|

Event type

|

2012–13

|

2013–14

|

2014–15

|

| Conferences |

7,606

|

7,636

|

7,775

|

| Case appraisals |

3

|

3

|

1

|

| Conciliations |

485

|

555

|

523

|

| Mediations |

42

|

39

|

13

|

| Neutral evaluations |

32

|

22

|

9

|

| Interlocutory hearingsa |

437

|

524

|

625

|

| Hearings |

1,063b

|

1,083

|

1,183

|

a Includes hearings relating to the jurisdiction of the Tribunal and hearings relating to applications for orders of the following kind:

– to extend the time to lodge an application for review

– to be joined as a party to a proceeding

– to make a confidentiality order under section 35 of the Administrative Appeals Tribunal Act 1975

– to stay the operation or implementation of a reviewable decision

– to dismiss an application

– to reinstate an application.

b The figure for the number of hearings conducted by the AAT in 2012–13 differs from the figure that appeared in the annual report for that year. A technical issue with the operation of the AAT's electronic case management system led to some hearings not being counted in the report for that year.

Table A4.8 Constitution of tribunals for hearings

|

Tribunal type

|

2012–13a

|

2013–14

|

2014–15

|

|

No

|

%

|

No

|

%

|

No

|

%

|

| Judge alone |

0

|

0

|

3

|

< 1

|

16

|

1

|

| Judge with 1 other member |

8

|

< 1

|

4

|

< 1

|

2

|

< 1

|

| Judge with 2 other members |

1

|

< 1

|

3

|

< 1

|

0

|

0

|

| Deputy President alone |

187

|

18

|

242

|

22

|

283

|

24

|

| Deputy President with 1 other member |

51

|

5

|

29

|

3

|

25

|

2

|

| Deputy President with 2 other members |

2

|

< 1

|

0

|

0

|

5

|

< 1

|

| Senior Member alone |

469

|

44

|

491

|

45

|

544

|

46

|

| Senior Member with 1 other member |

93

|

9

|

56

|

5

|

35

|

3

|

| Senior Member with 2 other members |

2

|

< 1

|

1

|

< 1

|

1

|

< 1

|

| Member alone |

239

|

22

|

243

|

22

|

269

|

23

|

| Two Members |

11

|

1

|

11

|

1

|

3

|

< 1

|

| Three Members |

0

|

0

|

0

|

0

|

0

|

0

|

| Totalb |

1,063

|

100

|

1,083

|

100

|

1,183

|

100

|

| Total multi-member tribunals |

168

|

16

|

104

|

10

|

71

|

6

|

a The figures for the number of hearings conducted by the AAT in 2012–13 differ from those that appeared in the annual report for that year. A technical issue with the operation of the Tribunal's electronic case management system led to some hearings not being counted in the report for that year.

b Percentages do not total 100% due to rounding.

Table A4.9 Appeals against decisions of the AAT – By jurisdiction

|

Jurisdiction

|

2012–13

|

2013–14

|

2014–15

|

|

Section 44a

|

Otherb

|

Section 44a

|

Otherb

|

Section 44a

|

Otherb

|

| Social security |

8

|

0

|

19

|

1

|

22

|

0

|

| Veterans' affairs |

8

|

1

|

11

|

0

|

6

|

0

|

| Workers' compensation |

17

|

2

|

24

|

2

|

21

|

0

|

| Taxation |

|

|

|

|

|

|

| Taxation Appeals Division |

22

|

4

|

18

|

0

|

17

|

2

|

| Small Taxation Claims Tribunal |

0

|

0

|

0

|

0

|

0

|

0

|

| Immigration and citizenship |

4

|

21

|

6

|

7

|

7

|

2

|

| Other |

13

|

2

|

18

|

1

|

18

|

2

|

| Total |

72

|

30

|

96

|

11

|

91

|

6

|

a Appeals lodged in the Federal Court under section 44 of the Administrative Appeals Tribunal Act 1975. In some circumstances, a party may lodge an application seeking relief under section 44 and under another enactment. These applications are treated as section 44 appeals for statistical purposes.

b Applications for judicial review made under other enactments, including the Administrative Decisions (Judicial Review) Act 1977, the Judiciary Act 1903, Part 8 of the Migration Act 1958 and section 75(v) of the Constitution.

Table A4.10 Outcomes of appeals against AAT decisions — By jurisdictiona

|

Outcome

|

2012–13

|

2013–14

|

2014–15

|

| |

Section 44

|

Other

|

Section 44

|

Other

|

Section 44

|

Other

|

| Social Security |

| Allowed/Remitted |

4

|

0

|

4

|

0

|

1

|

0

|

| Dismissed |

6

|

0

|

13

|

0

|

9

|

0

|

| Discontinued |

1

|

0

|

3

|

0

|

8

|

0

|

| Subtotal |

11

|

0

|

20

|

0

|

18

|

0

|

| Veterans' Affairs |

| Allowed/Remitted |

5

|

0

|

5

|

0

|

8

|

0

|

| Dismissed |

3

|

1

|

6

|

0

|

6

|

0

|

| Discontinued |

0

|

0

|

0

|

0

|

0

|

0

|

| Subtotal |

8

|

1

|

11

|

0

|

14

|

0

|

| Workers' Compensation |

| Allowed/Remitted |

9

|

0

|

11

|

1

|

6

|

0

|

| Dismissed |

9

|

1

|

14

|

1

|

10

|

2

|

| Discontinued |

1

|

0

|

3

|

0

|

4

|

0

|

| Subtotal |

19

|

1

|

28

|

2

|

20

|

2

|

| Taxation |

| Taxation Appeals Division |

| Allowed/Remitted |

7

|

1

|

6

|

1

|

4

|

0

|

| Dismissed |

11

|

1

|

11

|

0

|

13

|

1

|

| Discontinued |

3

|

0

|

4

|

0

|

5

|

0

|

| Subtotal |

21

|

2

|

21

|

1

|

22

|

1

|

| Small Taxation Claims Tribunal |

| Allowed/Remitted |

0

|

0

|

0

|

0

|

0

|

0

|

| Dismissed |

0

|

0

|

0

|

0

|

0

|

0

|

| Discontinued |

0

|

0

|

0

|

0

|

0

|

0

|

| Subtotal |

0

|

0

|

0

|

0

|

0

|

0

|

| Subtotal |

21

|

2

|

21

|

1

|

22

|

1

|

| Immigration and Citizenship |

| Allowed/Remitted |

1

|

9

|

0

|

3

|

1

|

3

|

| Dismissed |

2

|

12

|

3

|

11

|

4

|

9

|

| Discontinued |

2

|

1

|

1

|

1

|

3

|

0

|

| Subtotal |

5

|

22

|

4

|

15

|

8

|

12

|

| Other |

| Allowed/Remitted |

2

|

0

|

3

|

1

|

6

|

0

|

| Dismissed |

7

|

2

|

14

|

1

|

11

|

0

|

| Discontinued |

0

|

0

|

2

|

0

|

5

|

1

|

| Subtotal |

9

|

2

|

19

|

2

|

22

|

1

|

| Total |

73

|

28

|

103b |

20

|

104

|

16

|

| |

|

|

|

|

|

|

| All |

| Allowed/Remitted |

28

|

10

|

29

|

6

|

26

|

3

|

| Dismissed |

38

|

17

|

66

|

13

|

53

|

12

|

| Discontinued |

7

|

1

|

8

|

1

|

25

|

1

|

| Total |

73

|

28

|

103b

|

20

|

104

|

16

|

a Where a decision of a judge of the Federal Circuit Court, a single judge of the Federal Court or the Full Court of the Federal Court has been appealed, only the ultimate result is counted for the purpose of these statistics.